Navigating Food and Beverage Distribution: Expert Insights

In the fast-paced world of food and beverage distribution, success relies on effectively navigating complex supply chains and adapting to evolving consumer demands. This interview serves as a comprehensive guide to food and beverage distribution and explores essential aspects of wholesale distribution, including key challenges, best practices, and emerging trends. By examining successful case studies like Baldor Foods, this article offers valuable insights for industry professionals looking to enhance their operations and drive growth.

As the industry continues to evolve, distributors must embrace innovation and prioritize customer service to remain competitive. This interview article serves as a roadmap, providing practical strategies and expert perspectives to help you thrive in the dynamic landscape of food and beverage distribution.

Whether you're a seasoned professional or new to the field, the insights within will empower you to achieve operational excellence and meet the challenges of tomorrow.

An interview with George Ninikas, Senior Vice President Sales & Accounts at ORTEC and Ken Swagten, Presales Manager at ORTEC.

Overview

- What Does Food and Beverage Wholesale Distribution Entail?

- What Are Some of the Biggest Challenges Facing the Food and Beverage Supply Chain?

- How Has Technology Transformed the Distribution Process?

- What Are the Best Practices That Successful Foodservice Distributors Follow?

- Why Is Visibility in the Supply Chain Crucial for Food and Beverage Distributors?

- What makes Baldor Foods a successful case study in food and beverage distribution?

- What Trends Do You Foresee Shaping the Future of Food and Beverage Wholesale Distribution?

What Does Food and Beverage Wholesale Distribution Entail?

Food and beverage distribution is a vital component of the supply chain, encompassing the delivery of products to various businesses such as hotels, restaurants, grocery stores, convenience stores, and caterers. According to George Ninikas, Senior Vice President Sales & Accounts at ORTEC, distributors serve as intermediaries between manufacturers and retailers, ensuring that products reach the end consumer efficiently. They also cater to institutional clients, including schools and elderly homes, thereby broadening their scope of service.

In the food and beverage sector, distribution can be specialized. Some companies focus exclusively on food, while others concentrate solely on beverages. For instance, some major players primarily engage in food distribution, whereas other major companies manage their own beverage distribution. Ken Swagten, Presales Manager at ORTEC, emphasizes that this distinction is crucial, as it highlights the different operational models within the industry.

Moreover, the beverage sector often features a mix of distributors and manufacturers handling their own logistics. For example, a large beer beverage manufacturer operates its own trucks in certain regions while utilizing wholesalers in others. This hybrid model is common in the industry, allowing companies to adapt to varying market demands and operational efficiencies.

In the food sector, on the other hand, , there are broadline distributors, that handle a wide range of products, and specialty distributors, like Baldor Specialty Foods, that focus on niche markets such as organic or farm-raised products. The supply chains for these two types differ significantly due to the nature of the products and the customer base they serve.

What Are the Primary Functions of a Distributor in the Food and Beverage Industry?

Distributors play a crucial role in the supply chain, responsible for purchasing goods, managing inventory in their warehouses, and overseeing logistics. This includes transporting products to the final customer and handling order fulfillment. George Ninikas notes, “They are responsible for everything from receiving orders to delivering goods.” Distributors may also provide additional services, such as portioning, special labeling, or packaging, which can enhance the value they offer to their clients.

In the U.S., the role of merchandisers is particularly noteworthy. These individuals ensure that products are displayed attractively in retail outlets, maintaining product visibility and presentation in stores. Ken Swagten points out that during major events like the Super Bowl, creative displays of products from major beverage and snack manufacturers can be seen in grocery stores. He states, “These merchandising efforts are vital for attracting consumer attention and driving sales,” showcasing the importance of marketing within the distribution process.

How Do Manufacturers and Distributors Interact in This Sector?

While companies like the major players in beverages and snacks are primarily manufacturers, they also engage in distribution. However, from a wholesale distribution perspective, the complexity of food distribution often surpasses that of beverage distribution. George Ninikas explains, “The food distribution landscape is multifaceted, involving various products, supply chains, and customer needs.” This complexity makes it a unique sector within the broader wholesale distribution industry.

Ultimately, whether it involves food or beverage, the distributor's role is to ensure that products are available where and when they are needed while effectively managing the logistics and marketing aspects. As we delve further into the challenges, technological advancements, and best practices in this industry, it becomes clear that effective distribution is critical for the success of food and beverage businesses.

In the following sections, we will explore key challenges in the supply chain, the role of technology, and future trends shaping the food and beverage distribution landscape.

The food distribution landscape is multifaceted, involving various products, supply chains, and customer needs. This complexity makes it a unique sector within the broader wholesale distribution industry.

What Are Some of the Biggest Challenges Currently Facing the Food and Beverage Supply Chain?

The food and beverage supply chains faces numerous challenges that vary between the food and beverage sectors. Ken Swagten highlights that the food industry, particularly broadline distribution, is highly competitive due to its commodity nature. As a result, companies primarily compete on service quality. Conversations with customers often center around improving service levels, enhancing the Net Promoter Score (NPS), and ensuring on-time delivery. Ken emphasizes that if deliveries are late, the focus should be on resolving the issue rather than inundating customers with emails about the delay.

Efficiency remains a critical concern in the food industry, with specific challenges related to warehouse management and transportation. For instance, different food products, such as frozen chicken, French fries, lettuce, and bread, require separate storage and handling. This complexity is compounded by unique stock-keeping units (SKUs) that large fast-food chains may have, which complicates distribution due to the lack of density in the network. Ken notes, “It all boils down to service, and for many organizations, they are sales organizations. They think commercially first, and logistics is an expense.”

In addition to operational challenges, the industry faces issues such as unionization, which can impose requirements based on driver preferences or legal obligations. While there is a movement towards sustainability, Ken observes that it is more pronounced in manufacturing than in food distribution. He mentions, “Food distributors have a predominant national focus and although they are looking at making their business sustainable by introducing electrical vehicles (EVs) and other initiatives, it's not their biggest focus" .”

George Ninikas concurs with Ken's assessment, stating that cold chain management and food safety regulations are significant constraints in the industry. He explains, “If their objective is to sell more, these are the constraints.” Furthermore, margin pressure and competition add to the challenges faced by distributors. The integration of technology also poses difficulties, especially for companies that have evolved from family businesses with legacy systems. George emphasizes the need for seamless ordering and connectivity with transportation partners as a major hurdle.

How Do Seasonal Fluctuations Impact Supply Chain Operations in This Industry?

Seasonal fluctuations significantly impact supply chain operations in the food and beverage industry. Ken notes that November and December are particularly busy periods, with volumes skyrocketing due to holidays like Thanksgiving and Christmas. This surge in demand complicates logistics, as companies must manage increased orders while also dealing with driver availability during peak times.

Ken suggests that companies should employ scenario management to prepare for these fluctuations. He states, “They should use the tools available in zone engineering, visit optimization, or standard routing to create scenarios with additional volume.” This proactive approach allows businesses to anticipate demand spikes and plan accordingly. However, George adds that while certain seasonal events are predictable, weekly volatility can be less so. He explains, “In Europe, for example, every time there’s sun, people storm out, restaurants open their terraces, and demand increases.” This unpredictability necessitates operational agility and flexibility to adapt to changing conditions.

What Strategies Do You Recommend for Overcoming These Challenges?

To address the challenges in the food and beverage supply chain, Ken recommends that companies first clarify their strategic goals. He emphasizes the importance of understanding how a company wants to compete, stating, “Supply chain problems are often tackled in silos, not as a whole company.” By aligning goals and procedures, organizations can achieve greater efficiency and service levels. He cites one of our customers Primo Brands as a successful example of a company that grouped its operations to achieve significant improvements.

Ken also advises companies to examine their business rules and constraints, many of which may be outdated and self-imposed. He notes, “Technology has changed, and opportunities have shifted.” By adopting a more dynamic approach, companies can enhance their operations without sacrificing speed or efficiency. He suggests that businesses should view static versus dynamic operations as a spectrum, allowing for flexibility where necessary.

George adds that operational flexibility is crucial, particularly in forecasting. He believes that companies can capitalize on improved forecasting methods to enhance their proactive planning. He states, “Forecasting is crucial for addressing concerns about fleet sizing and subcontractor agreements.” By preparing for volatility and understanding demand patterns, companies can better manage their resources and avoid overcapacity or shortages.

In summary, the food and beverage supply chains face significant challenges, from competition and service quality to seasonal fluctuations and operational inefficiencies. However, by adopting strategic planning, leveraging technology, and maintaining operational flexibility, companies can navigate these challenges effectively and position themselves for success in a competitive market.

In the next section, we will explore the role of technology in distribution.

How Has Technology Transformed the Distribution Process?

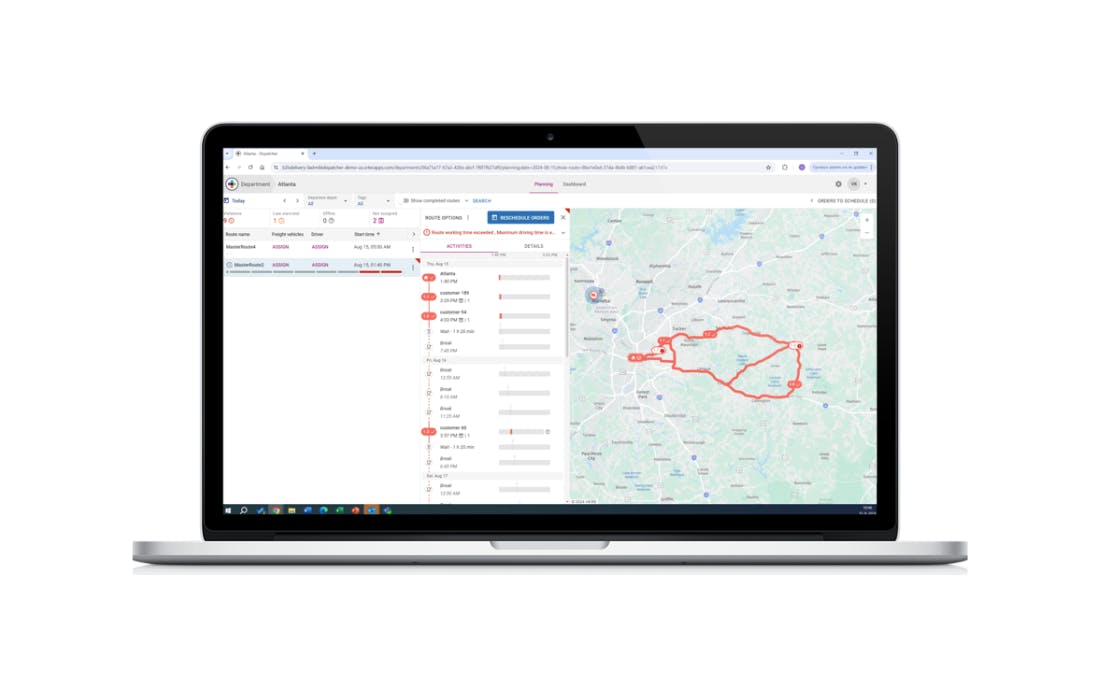

Technology has fundamentally transformed the distribution process in the food and beverage industry, enabling companies to navigate the complexities of customer requirements and operational challenges. George Ninikas emphasizes that to be proactive and agile in today’s fast-paced environment, businesses cannot afford to overlook technology. He states, “Technology is the main vehicle driving change and transformation to excel through these challenges.” For instance, the integration of route optimization technology is essential for balancing static and dynamic distribution needs. George further notes that forecasting, which is critical for effective planning, is also heavily reliant on technology due to its inherent complexity.

Can You Share Examples of How Technology Has Improved Efficiency or Reduced Costs in Distribution?

Ken Swagten adds that technology can enhance the intelligence of static components within the distribution process. He explains, “If part of your process is static, do you review it on a calendar basis or by change? Technology can help identify when updates are needed.” By leveraging technology to update territories, bidding processes, and other operational setups, companies can remove unnecessary boundaries and streamline their distribution processes.

A practical example of this transformation can be seen in the case of one of our customers, where the focus is on improving service levels and efficiency. Ken describes how the client has optimized its operations by getting routes to the warehouse early, allowing for better overlap between loading crews and routing processes. This approach not only streamlines information but also keeps customers in control, ultimately adding significant value to the distribution process.

What Are the Potential Drawbacks or Limitations of Relying on Technology in Distribution?

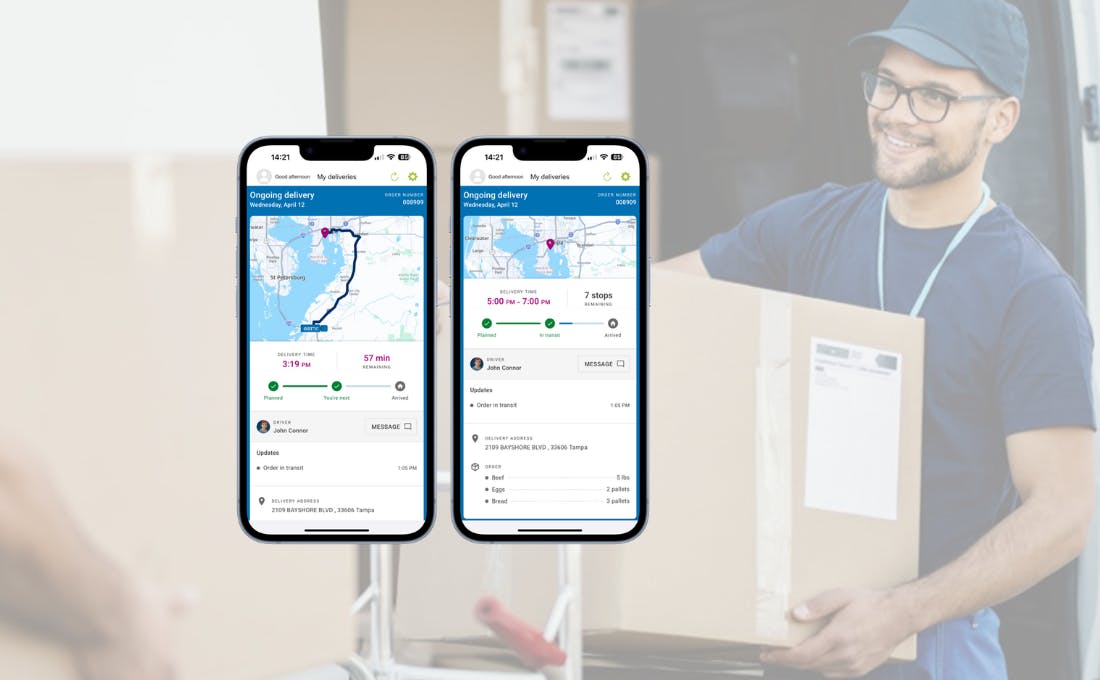

While the benefits of technology are substantial, there are potential drawbacks to consider. Ken acknowledges that while stability issues that plagued earlier technologies have largely been resolved, the adoption of technology remains crucial. He cautions that poorly designed technology can hinder operations, stating, “If a mobile app is slow or difficult, that’s a problem.” However, when technology is purpose-built, like ORTEC's solutions, it should be user-friendly and efficient.

George adds another layer to this discussion by highlighting the importance of frequency optimization in distribution. He explains that as businesses build relationships with customers, such as bars or restaurants that receive regular deliveries, they may find themselves making unnecessary daily visits. With the help of technology, companies can review agreements and identify better synergies, allowing them to optimize delivery schedules and reduce unnecessary trips. This not only saves time but also enhances overall efficiency.

In summary, technology plays a pivotal role in transforming the distribution process within the food and beverage industry. From route optimization and forecasting to frequency optimization, the integration of technology enables companies to improve efficiency, reduce costs, and enhance customer satisfaction. While there are challenges associated with technology adoption, the potential benefits far outweigh the drawbacks when implemented effectively.

As we continue to explore the best practices and future trends in food and beverage distribution, it is clear that leveraging technology will remain a key factor in achieving operational excellence and maintaining a competitive edge in this dynamic industry. In the next sections, we will delve into best practices for foodservice distribution and the importance of visibility solutions in the supply chain.

Technology is the main vehicle to excel through these challenges.

What Are Some Best Practices That Successful Foodservice Distributors Follow?

Successful foodservice distributors prioritize cost management and customer service, recognizing that they are fundamentally sales organizations. Ken Swagten emphasizes that on-time delivery (OTIF), effective customer communication, and maintaining safety and quality are essential components of their operations. He states, “Vehicles should be in proper shape, properly loaded with products, and maintain the right temperature.” Additionally, informing customers of arrival times is crucial, as is having well-trained drivers who serve as the first line of sales interaction.

George Ninikas adds that while country-specific regulations, such as weight limits or access to city centers, may vary, the core challenges remain consistent across regions. He notes, “The specific rule doesn’t really matter. Whether it’s a weight limit or an access restriction, you need the overall flexibility to incorporate rules and you will be successful regardless of the specifics.” This adaptability is vital for navigating the complexities of foodservice distribution.

Furthermore, George highlights the importance of technology integration as a best practice. He advocates for enabling e-commerce portals for customers to place orders online, which should be connected to inventory systems, warehouse management systems, and route planning tools. He asserts, “Technology integration is a must,” as it streamlines operations and enhances customer experience.

How Do You Ensure Quality and Safety in Foodservice Distribution?

Quality and safety are paramount in foodservice distribution, particularly regarding temperature control. George explains that temperature management is typically handled through IoT devices installed on trucks or in warehouses, ensuring that food products are transported under the right conditions. He emphasizes, “Temperature control cannot be violated,” highlighting the critical nature of this aspect of food safety.

Ken adds that ensuring that the right foods reach customers on time and in suitable vehicles is essential. He notes, “In food distribution, safety and quality involve ensuring the right foods get to customers on time and on the right type of vehicle.” This focus on quality assurance is vital for maintaining customer trust and satisfaction.

What Role Does Customer Service Play in Effective Distribution?

Customer service is the cornerstone of effective foodservice distribution. George asserts that from the customer’s perspective, successful service means receiving orders on time, in full, and in the right conditions. He explains, “Delivering on time, in full, and in the right conditions is the main responsibility of foodservice distributors.” However, distributors can enhance customer service by allowing end customers to select their preferred delivery times, which can be facilitated through smart route optimization.

Ken emphasizes the importance of balancing efficiency with customer service. He warns against improper use of technology, stating, “If technology starts cutting down stop times, there’s a risk of rewarding rushing and unprofessional behavior during deliveries.” He shares an anecdote about a delivery person who adjusted the way he stacked boxes to accommodate the staff at a restaurant, demonstrating how small, thoughtful actions can significantly impact customer relationships. He concludes, “Sometimes that’s worth a few extra dollars. That’s the sales, service, and volume we talk about.”

In summary, best practices for foodservice distribution revolve around effective cost management, customer service, and technology integration. By prioritizing on-time delivery, maintaining quality and safety standards, and fostering strong customer relationships, distributors can enhance their operational efficiency and drive business growth. As we move forward, it will be essential to explore the importance of visibility solutions in the supply chain and how they contribute to overall success in the food and beverage distribution industry.

It all boils down to service, and for many organizations, they are sales organizations. They think commercially first, and logistics is an expense.

Why Is Visibility in the Supply Chain Crucial for Food and Beverage Distributors?

Visibility in the supply chain is essential for food and beverage distributors for several reasons. Ken Swagten emphasizes that visibility begins with tracking actual delivery metrics. This tracking can be accomplished through mobile devices carried by drivers, which are equipped with scanning capabilities and GPS, or through devices installed directly on vehicles. Both methods provide critical real-time data that enhances operational efficiency.

Ken explains that visibility can be categorized into two types: internal and external. External visibility is primarily focused on customer service, allowing customers to track their orders throughout the delivery process. This includes knowing the journey's lifespan, the estimated time of arrival, and the quantity of products being delivered. Such transparency not only improves customer satisfaction but also builds trust between distributors and their clients.

On the other hand, internal visibility is centered around monitoring progress within the organization. It involves management by exception, which helps identify potential issues, such as a time-sensitive delivery being delayed or a driver nearing their maximum hours of service. By having tools in place to manage these exceptions, distributors can respond proactively to customer inquiries and operational challenges. Ken notes, “Ideally, you move that external visibility to an app for ease, while internal visibility focuses on managing exceptions and ensuring the plan is executed.”

What Tools or Solutions Are Available to Enhance Supply Chain Visibility?

To enhance supply chain visibility, various tools and solutions are available. These include mobile applications that provide real-time tracking information to customers, as well as internal dashboards that allow management to monitor delivery progress and identify potential issues. Ken highlights the importance of integrating these technologies to streamline operations and improve communication between teams.

George Ninikas, Senior Vice President at ORTEC, adds that real-time tracking of products, vehicles, and delivery statuses is crucial. This level of visibility enables distributors to make informed decisions and respond quickly to any disruptions in the supply chain. By leveraging technology effectively, companies can enhance their operational capabilities and improve overall service quality.

Can You Discuss the Impact of Improved Visibility on Decision-Making and Operations?

Improved visibility in the supply chain has a significant impact on decision-making and operations. With access to real-time data, distributors can make more informed choices regarding routing, inventory management, and customer service. Ken explains that when visibility is enhanced, it allows for better management of exceptions, leading to more efficient operations. For example, if a delivery is running late, the internal visibility tools can alert management to take corrective actions before the situation escalates.

Moreover, enhanced visibility fosters a culture of accountability within the organization. When teams have access to accurate data, they can better understand their performance metrics and identify areas for improvement. This transparency not only helps in optimizing operations but also contributes to a more responsive and agile supply chain.

In conclusion, visibility solutions are crucial for food and beverage distributors as they enhance customer service, improve internal operations, and facilitate better decision-making. By investing in the right tools and technologies, companies can achieve greater efficiency and responsiveness in their supply chain processes. As we continue to explore the future trends in food and beverage distribution, it will be essential to consider how visibility solutions can further drive success in this dynamic industry.

Real-time tracking of product, vehicle, and delivery status is key in providing world class customer service.

What makes Baldor Foods a successful case study in food and beverage distribution?

Baldor Foods is recognized as a successful case study in food and beverage distribution due to its focus on niche markets, particularly organic and specialty products. The company has established itself as a leader in providing high-quality, fresh produce and specialty foods to restaurants, hotels, and retailers. Its commitment to sourcing locally and sustainably has resonated with consumers and businesses alike, allowing Baldor to build strong relationships with its suppliers and customers. This focus on quality and service has positioned Baldor Foods as a trusted partner in the foodservice industry.

What specific strategies or innovations has Baldor Foods implemented to achieve success?

Baldor Foods has implemented several strategies and innovations that contribute to its success in the distribution sector. One key strategy is its emphasis on technology integration, which enhances operational efficiency and improves customer service. By utilizing advanced inventory management systems and real-time tracking technologies, Baldor can ensure that products are delivered fresh and on time. Additionally, the company has invested in a robust logistics network that allows for efficient routing and distribution, minimizing waste and optimizing delivery schedules.

Furthermore, Baldor Foods has focused on building strong partnerships with local farmers and suppliers, enabling them to offer a diverse range of high-quality products. This commitment to local sourcing not only supports regional agriculture but also aligns with the growing consumer demand for sustainable and ethically sourced food.

How Can Other Distributors Learn from Baldor Foods' Approach?

Other distributors can learn valuable lessons from Baldor Foods' approach by prioritizing quality, sustainability, and technology integration in their operations. By focusing on niche markets and understanding customer preferences, distributors can differentiate themselves in a competitive landscape. Additionally, investing in technology to enhance visibility and efficiency can lead to improved service levels and customer satisfaction.

Building strong relationships with suppliers and local producers is another key takeaway. By fostering these partnerships, distributors can ensure a consistent supply of high-quality products while supporting local economies. Finally, adopting a proactive approach to sustainability can not only meet consumer expectations but also create a positive brand image that resonates with environmentally conscious customers.

In summary, Baldor Foods exemplifies how a focus on quality, innovation, and sustainability can lead to success in the food and beverage distribution industry. Other distributors can adopt similar strategies to enhance their operations and better serve their customers.

What Trends Do You Foresee Shaping the Future of Food and Beverage Wholesale Distribution?

As the food and beverage wholesale distribution landscape evolves, several key trends are expected to shape its future. George Ninikas identifies forecasting as a significant trend that is becoming increasingly prevalent in commerce. He notes, “We are starting to see this with the industry leaders, but I believe it will become more common as awareness grows” Enhanced forecasting capabilities will enable distributors to better anticipate demand and optimize their operations accordingly.

Additionally, the conversation shifts towards the modes of delivery that may emerge in the future. While George acknowledges the potential for different transport methods, such as drones, he emphasizes that the nature of food and beverage orders—often heavy and bulky—makes drone delivery impractical for most cases. Instead, he sees autonomous trucks as a more immediate possibility, although he points out that challenges remain, particularly in unloading products once they arrive at their destination.

How Might Emerging Technologies Influence Distribution Practices in the Coming Years?

Emerging technologies are poised to significantly influence distribution practices in the coming years. Ken Swagten highlights a trend towards greater integration within the distribution process, particularly in beverage distribution. He notes the importance of integrating merchandising with delivery, which can streamline operations and enhance customer service. Furthermore, he mentions the ongoing trend of centralization, which can lead to more efficient resource allocation and improved operational effectiveness.

Ken also expresses hope for advancements in technology that support warehouse workers and drivers, such as exoskeletons. He points out that health issues are prevalent in the industry, and these innovations could contribute to a healthier workforce. The integration of machine learning and proactive decision-making tools will also play a crucial role in shaping the future of distribution, allowing companies to respond more effectively to changing market conditions.

What Roles Do Sustainability and Environmental Concerns Play in the Future of Distribution?

Sustainability and environmental concerns are increasingly influencing the future of food and beverage distribution. As consumers become more environmentally conscious, distributors are under pressure to adopt sustainable practices. This includes reducing carbon footprints, optimizing transportation routes to minimize fuel consumption, and exploring eco-friendly packaging solutions.

While the discussion did not delve deeply into specific sustainability initiatives, it is clear that these concerns will continue to shape the strategies of food and beverage distributors. Companies that prioritize sustainability will not only meet consumer expectations but also position themselves competitively in a market that increasingly values environmental responsibility.

If technology starts cutting down stop times, there’s a risk of rewarding rushing and unprofessional behavior during deliveries. Technology needs to be smart to enable and allow people to still be people.

Conclusion

In summary, the future of food and beverage wholesale distribution will be shaped by trends such as enhanced forecasting, the integration of emerging technologies, and a growing emphasis on sustainability. As the industry adapts to these changes, distributors will need to embrace innovation and prioritize efficiency to remain competitive. By leveraging advancements in technology and addressing environmental concerns, food and beverage distributors can position themselves for success in an evolving marketplace.

As we conclude this comprehensive guide, it is evident that the food and beverage distribution sector is dynamic and continually evolving, driven by technological advancements and changing consumer expectations.

Get Started

Are you ready to transform your food and beverage distribution operations?

See our technology in action and experience the difference.