Data-driven decisions. Better results.

Data-driven decisions.

Better results.

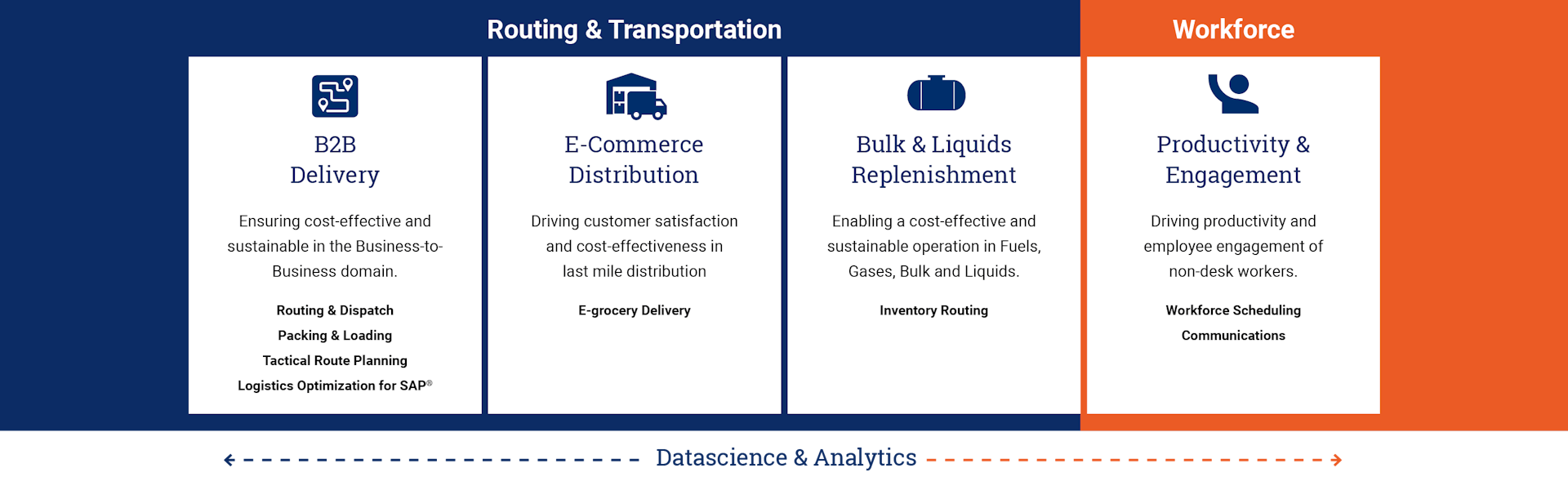

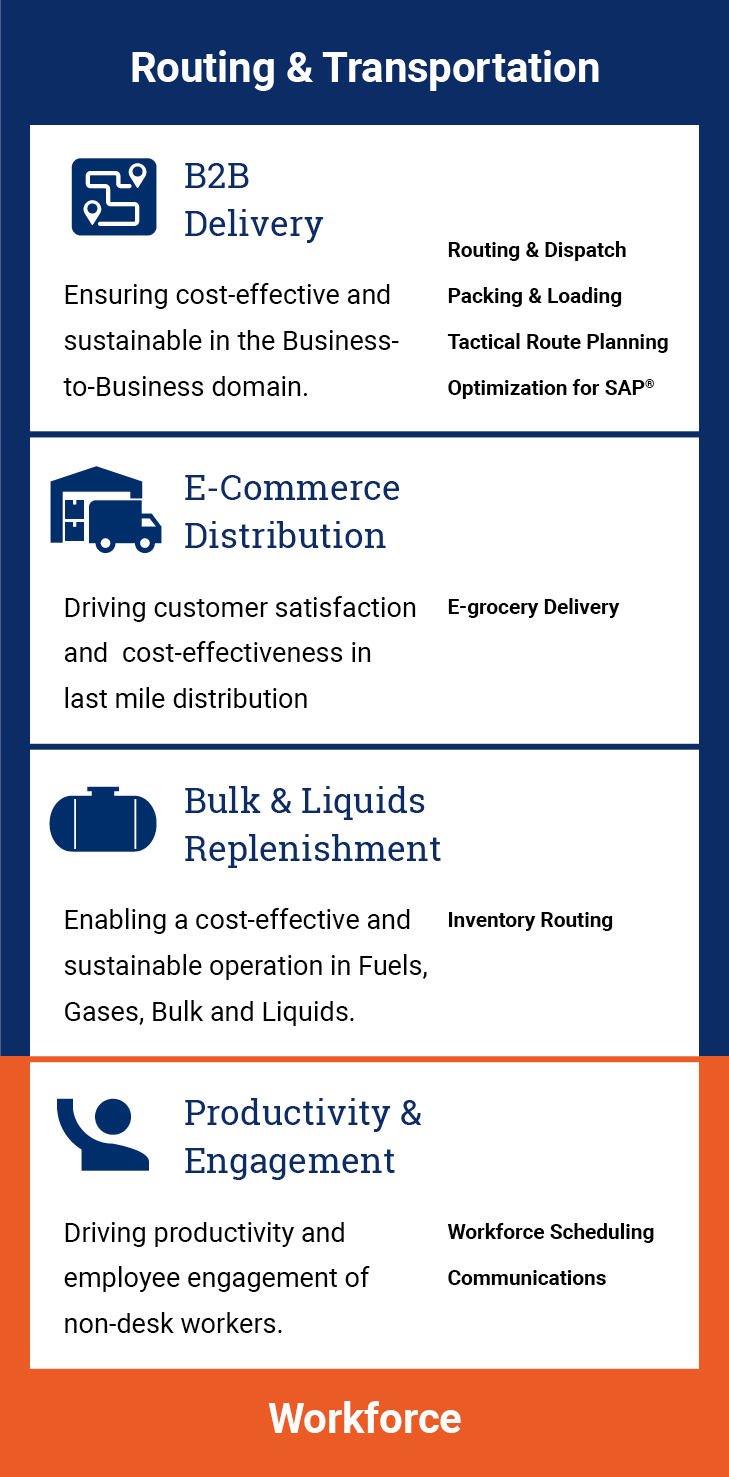

We help many of the world's best-run organizations make better data-driven decisions. Our decision support software and data science expertise enable you to improve your business results and make a positive impact on the world.

40+ years of experience

1,100+ leading customers

900+ passionate employees

17 offices across the globe

Industries We Work For

On our journey to help organizations make better business decisions, we focus on six industries while also serving a few others. Our smart decision-support solutions make your business more efficient, predictable, and sustainable.

Georgios Sarigiannidis - CEO

The Impact We Create

"Our decision support not only helps your business, but also contributes to a better world. The positive impact we create together is measured according to the UN Sustainable Development Goals. We are proud that our impact on the world is growing every year."

586Kton CO2

We helped our customers prevent 586 kilo tons of CO2-e emissions in 2024.

1M People

Through our products and services, we reached just under a million people in 2024.

1.4B USD

We improved the financial performance of our customers by $1.4 billion in 2024.

Impact Cases